Fast Car Title Loans in Elk Grove

At times, during cash emergencies, it’s hard to find an instant means to get money. Traditional loans will not work in such cases and frankly, not everyone can afford to cash out a large check and still remain financially comfortable. If you are worrying about where to get money, stop worrying because car title loans in Elk Grove have you covered.

A car title loan in Elk Grove is a loan that allows you to borrow money based on the value of your car which is used as collateral for the loan. They are common among people as they offer a quick solution to money problems. Being a short term loan, it should be paid on time as late payments and call for increased interest rates. The worst case scenario is that one can lose their car. Once you qualify for a car title loan in Elk Grove, your lender retains one set of keys to your car and you get them once the loan is repaid in full. So what should you do when in need of a car title loan in Elk Grove?

Identifying a Trusting Car Title Loan Lender in Elk Grove California

Choosing where to borrow fast car title loans Elk Grove from is very important. Usually, most lenders give consumers the option to borrow either online or go to the local office and fill out the required forms. There are those that just give one of the above options. Whether you are borrowing from a local lender in Elk Grove California or an online one, scout different companies and study the viability of their business practices as well as their interest rates. This will serve to give you the assurance that you are gaining from your car title loan in Elk Grove and not losing. This is because not every company is legitimate.

What are the Car Title Loans Elk Grove Requirements?

Like any other loan, you have to meet standard eligibility requirements in order to qualify for a car title loan in Elk Grove. Thankfully, not much is required of applicants. For starters, you should own a car that’s worth more than what you will be borrowing. Secondly, you have to prove your ability to pay off the loan. That means showing proof income. Proof of identity is also required. Unlike traditional loans, your credit score doesn’t have to be stellar.

As a borrower, you are required to familiarize not only with the eligibility requirements of car title loans in Elk Grove, but the whole borrowing and lending industry as well. That way, you are equipped with the knowledge on what personal details to give your lender and what should be kept personal.

What’s used as collateral for the Fast Title Loans in Elk Grove?

As you probably know, car title loans in Elk Grove are secured by your car. When you qualify for the loan, you are required to hand over the title of your car as well as a spare set of keys. Once the fast car title loan is paid off, your lender hands over the title and the keys back to you. The amount of money you borrow from your Elk Grove fast car title loans is proportional to the value of your car. You therefore have complete control over the loan.

Auto Title Loans Elk Grove Interest rate

The interest rate charged on borrowed car title loans in Elk Grove differs from one lender to another. It also depends on the amount of money borrowed as well as the length of the repayment period. Before deciding on the lender to borrow from, familiarize with their interest rates. Are they fixed or are they subject to change over time? Can you afford to pay it? Whatever interest rate you go for, make sure it works for you.

What are the Terms of repossession at Title Loans Elk Grove

For varied reasons, you may be forced to make late payments and eventually, your lender may have to repossess your car. It’s therefore vital that you understand your lender’s terms of repossessing your car. Consult and find out if there are alternative options like extending the repayment period. For instance, some lenders will give borrowers one month, probably more, after the due date to pay the loan before taking away your car.

Best Way to Keep up on your payment…

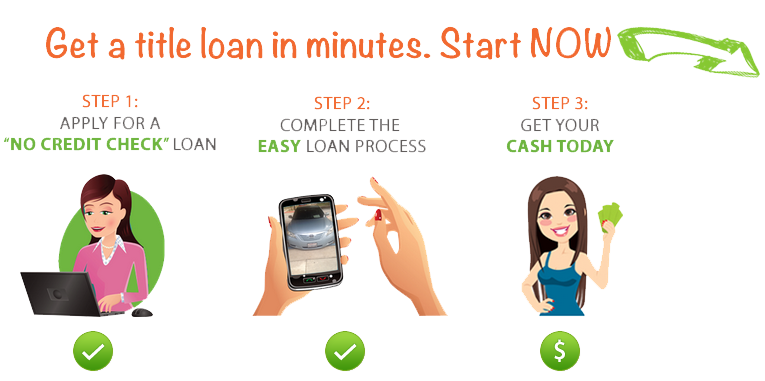

The sector of car title loans in Elk Grove is an ever evolving one. Companies now have updated software that allows clients borrow money from the comfort of their homes. And this is not the end of it. The coming years will see more changes in the industry. It’s therefore important to keep yourself updated.

If you have an urgent need for money, say you want to finance a project you’ve been working on, consider looking up car title loans in Elk Grove. The interest rates are reasonable, and so is the repayment period.

Fast Car Title Loans Elk Grove is Your Trusted Source for Quick Auto Title Loans

More about Elk Grove California

Elk Grove is a very beautiful city in the Sacramento County of California. Elk grove is the 2nd largest city in the Sacramento County with over 160,000 people! It was the fastest growing city in the early 2000’s! Elk Grove California was founded in 1850 by travelers coming from the bay area, and is now home to many great people in Northern California! Click to learn more about Elk Grove…