Fast Car Title Loans in Corona California

Is A Car Title Loan In Corona Really For You?

Are you in urgent need of money? Have you run out of options to get money? Car title loans in Corona could offer the solution that you are looking for. Also referred to as car pawning, car title loan is one where the client’s car is used to secure the loan. The client hands over a spare set of car keys as well as the title of the car used as collateral. Should one fail to repay the loan, the lender sells the car to recover the loan. The value of the car is vital in determining how much money one can borrow.

Car title loans in Corona are quite easy to access. But despite that, there are those who doubt whether they are the right source of fast cash. The reason for this hesitation probably stems from the fact that they are viewed as payday loans; and as you know payday loans are associated with high interest rates, especially in case of late payments.

While that may be a viable reason not to borrow a car title loan in Corona, there’re also viable reasons why this would work for you. Why stress yourself when this could be the solution you’ve been looking for? So can a car title in Corona work for you? Absolutely, and here are a few reasons why.

Car Title Loan Corona penalties:

As you know, defaulting on payments can lead to higher interest rates. It’s also common knowledge that fast loans come with high interest rates. As a result, you do not want to worry about how high the interest rates for a car title loan in Corona and how badly they can affect your finances. However, the penalties for title loans in Corona don’t come with high interest rates. Moreover, the penalty for late payment is not high.

At Car Title Loan Corona, get cash and remain in possession of your car:

A lot of people worry that borrowing a car title loan in Corona means that they have to relinquish ownership of their car until the loan is repaid. Contrary to that mentality, a borrower is only required to turn over the title of the car as well as a spare set of keys to the lender and once the loan is paid, you can repossess them. This means that you get the money and remain in possession of your car. The lender will only assume ownership if fail to pay the car title loan in Corona.

Your credit score will never stop you from getting an auto title loan:

There’s a common misconception among people that one has to have a good credit score in order to qualify for a car title loan in Corona. Fortunately, your credit score is not considered by title loan lenders. That means that you don’t have to get a new credit check. All you have to do to get the loan is prove that you are capable of paying the car title loan in Corona.

Get more cash and at a fast pace with title loans in Corona:

If you have ever taken a payday loan, you know that it has a low loan limit, which may not always work for cash emergencies. On the other hand, car title loans in Corona have higher loan limits. This is because the amount of payday loans given depends on one’s income while the amount of title loan given depends on the equity of the borrower’s car. As a result, the limit of car title loans in Corona is always higher than that of payday loans.

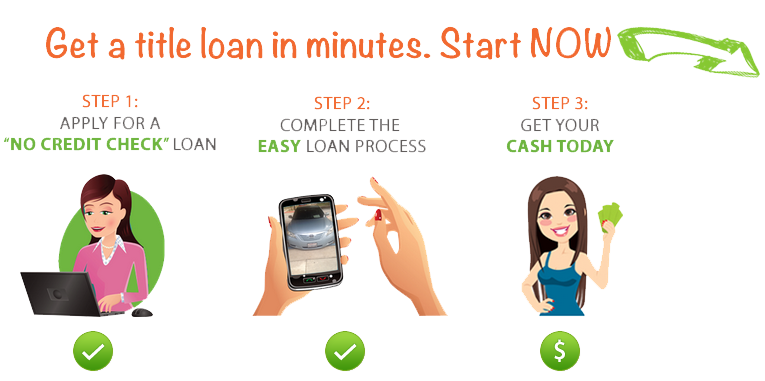

Car title loans have a fast approval process:

Unlike traditional loans that take weeks to process, car title loans in Corona take shorter to approve. This is attributed to the fact that there are no credit checks. All you have to do is prove your identity, ability to pay the loan and turn over your car’s title.

Convenience:

Everybody deserves convenience in every aspect of their loans, including car title loans in Corona. The ability to apply for the loan by simply filling out an online form as well as the fact that one can make enquiries by calling a toll free number offers a high level of convenience for the borrower. Fast approval process is an added bonus.

It’s normal to have cash emergencies and at such times, the best you can do is to get a car title loan in Corona. There are no risks to worry about and they go a long way in getting you out of a financial crisis.